Market Review for Friday

IL prices were higher in trading early Friday morning, as traders reacted to a weaker US dollar. The greenback was following through on the selloff that had started Thursday afternoon, after failing to break through resistance @ 74.15 euro cents. The buying in oil picked up pace on news that US Gross Domestic Product (GDP) had grown at 5.9% (annual rate) in the fourth quarter of 2009. That was the fastest rate of growth for any quarter since the third quarter of 2003. A month ago, the Commerce Department had estimated fourth quarter, 2009 growth at 5.7%. On Friday, third quarter GDP growth was confirmed to have been 2.2%. These figures helped push crude oil prices higher.

The US dollar also was weaker on Friday, as investors pushed their money into what some are now calling “risk-positive currencies” (Dow Jones). There was news that the German government had been discussing a possible emergency credit package for Greece. Those involved refused comment, and sources for the report stressed nothing had been decided, yet.

The UK also reported updated fourth quarter results, showing a 0.3% gain in GDP. That was better than initially reported, and it suggested that the UK had ended its recession with more momentum than originally believed. This also boosted oil prices.

Investors shrugged off an unexpected 7.2% drop in existing American homes sales to a 5.05 million annual pace, against estimates suggesting an increase of 0.9% to a 5.50 million annual rate. That represents an 8.2% swing against expectations.

Because of the heavy snowfall, which spun in a circle around Manhattan, many traders and brokers left early or operated from home on Friday, and that added to the volatility in a number of markets. March refined products had some especially wide bid-and-ask spreads, as a result of Friday’s expiration.

At this stage, we have to expect longer and more powerful bouts of optimism – and running help from equities or currencies. There is no legitimate fundamental reason for higher prices, but it is March 1st, so we have to expect to see them. Reasons have a way of materializing at this time of year.

Courtesy Peter Beutel

Technical Recap

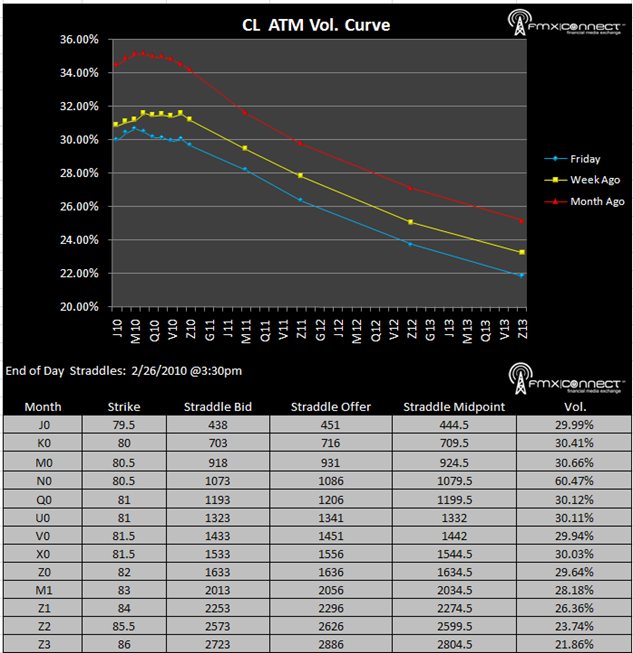

Volatility Term Structure

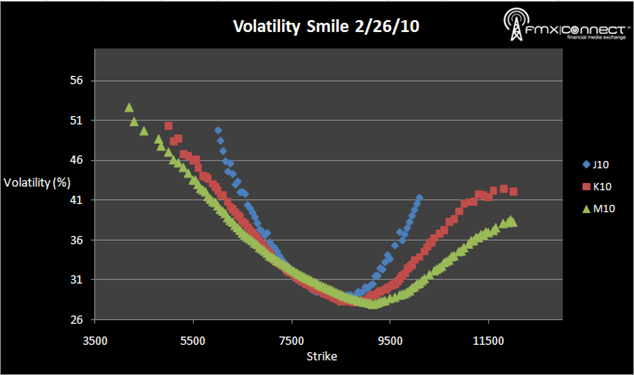

Volatility Smile

***From NYMEX Settlements

Significant Activity:

1. M10 9000 C

2. M10 7000 P

3. Z10 5000 P

Premium Subscribers (click here to register):

Volumes & Open Interest

End Of Day Straddles

Trade Blotter

Settlements