Natural Gas & Utility Generation

Natural gas prices rallied a little more than 16 cents on Friday, as bargain-hunting reportedly returned to the market. The fact that temperatures had taken a sudden turn towards colder readings does not seem to have had any more than a fleeting psychological impact on Nymex traders, and most observers are past the point of factoring temperatures into any near-term thinking about prices.

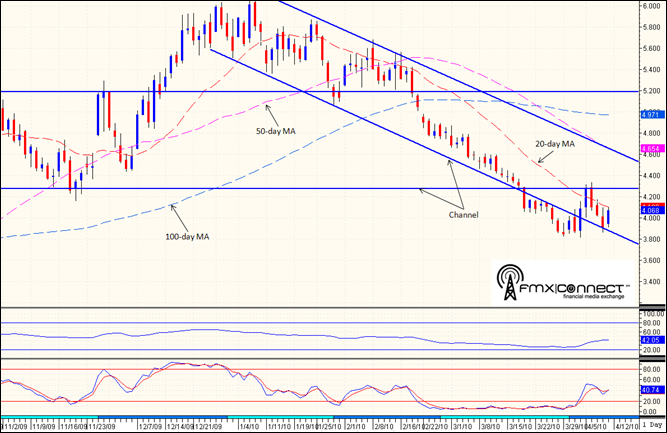

Winter is over, and summer cooling season is weeks away. Fundamental factors seem to have had their say, and more traders were taking their cues from charts than reports on Friday. The charts show a market that has found support between $3.81 and $3.86, and prices managed to hold above those levels as we ended the week. The latest commitments of traders report showed everyone except managed money accounts buying through last Tuesday, and the expectation is that this same group of traders was buying on Friday. The funds were selling through last Tuesday, but buying by commission houses, producers, end-users and swap dealers finally overwhelmed the managed money accounts. They had actually been buying in the previous five-day period and, if they decided to cover shorts or get long on Friday, it would have left no one on the sell side.

That is where we should end up eventually, even if the funds resume heavy selling this week. At some point – and prices just below $4.00 seem as good a place as any to start this process – sellers will see diminishing returns in the short side. If the funds even just stop selling, the rest of the market should bid quotes higher from here.

Baker-Hughes reported an increase of 10 rigs to active status in the latest week, and that takes the number of active rigs to 959. The number of active rigs peaked at 1,606 in September, 2008, and has been rising recently.

Courtesy Peter Beutel

Technical Recap

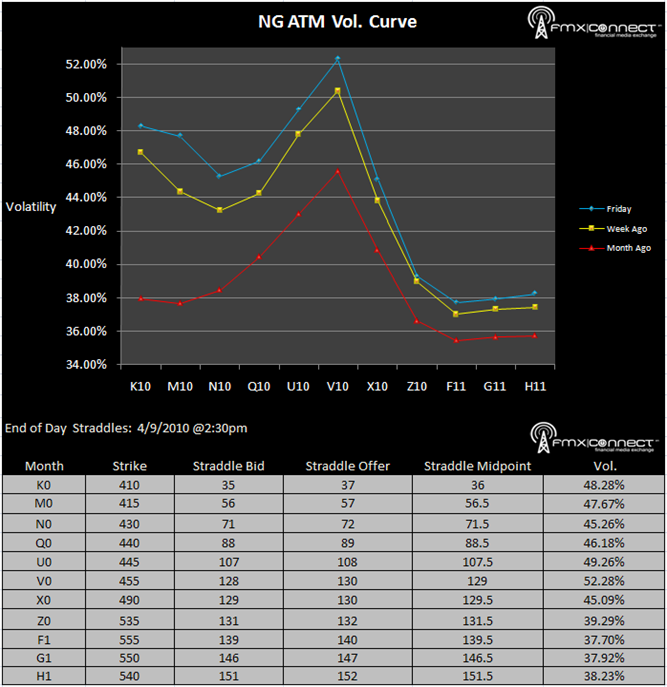

Volatility Term Structure

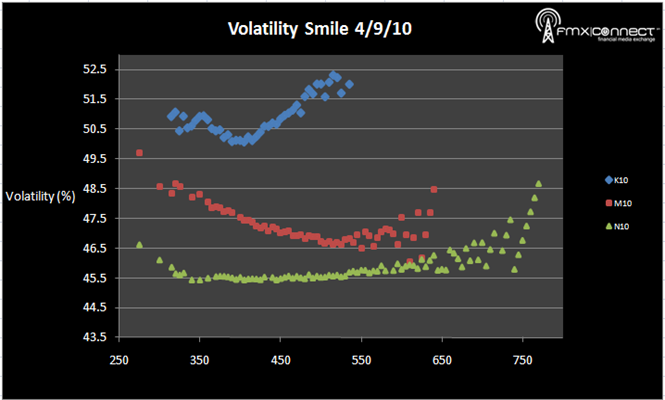

Volatility Smile

***From NYMEX Settlements

Significant Activity:

1. M10 8000 P

2. K10 8000 P

3. M10 7500 P

Premium Subscribers (click here to register):

Volumes & Open Interest

End Of Day Straddles

Trade Blotter

Settlements