Market Review for Friday

he US economy expanded at a rate of 3.2% in the first quarter, the Commerce Department reported on Friday. The increase was the largest gain in GDP over six months since 2003. The economy had been forecast to rise at a rate of 3.3%, and Friday’s gains in GDP contributed to the rise in oil prices. American households spent more freely and the stage is now set for stronger gains in employment over the remaining half year, Bloomberg noted, suggesting that consumers will play a larger role in the recovery in the months ahead, putting the recovery on a stronger footing. Consumer spending has traditionally accounted for 70% of US GDP in

previous years. Investors found the first quarter’s growth rate of 3.2% especially promising, coming, as it did, on the heels of the 5.6% gain in GDP in the fourth quarter.

Consumer spending increased by 3.6% in the first quarter, which was up by more than the 3.3% increase expected by the average of economists polled and was well above the 1.6% increase seen in the fourth quarter. It was the biggest increase since the first quarter of 2007, three years ago. Consumer spending added 2.55 percentage points to GDP, after household purchases fell by 0.6% in 2009, which was the largest decline since 1974.

Oil prices were higher on the GDP numbers, the unemployment figures from Thursday, and the Fed comments on Wednesday. On Friday, the DJIA was lower, with the index down around 10 points through midday. The dollar was effectively lower on Friday, although the greenback started to receive some support in the early afternoon.

On Friday, investors also received support (for the long side in the carry trade or for risk trades) from the Institute for Supply Management (ISM). Its Chicago index increased to 63.8 in April, up from 58.8 in March. The ISM noted that production gains have enticed companies to add workers, and manufacturers are going to have to gear up activities to keep pace with final demand, the manufacturers’ association said. The ISM will release its monthly, national factory index on Monday. The Labor Department will release its monthly unemployment report this Friday.

Profit-taking pushed the DJIA lower as we worked through the afternoon, last Friday. Oil traders kept prices in positive territory, buoyed also by news of a militant attack on a pipeline system in Nigeria. May refined products contracts expired on Friday afternoon, and that seems to have added a layer of short-covering to the market which might not otherwise have been active.

Crude oil prices were up nearly a dollar by the final bell, with May refined products prices up nearly four cents a gallon as those expiring contracts went off the board. With the DJIA down 158 points at its final bell, this rally in oil markets has to be seen as being the end-result of promising economic data.

Oil investors proved this week that they can take almost anything one can associate with economic recovery and draw from there a line running directly through heavy, resurgent oil demand.

Courtesy Peter Beutel

Technical Recap

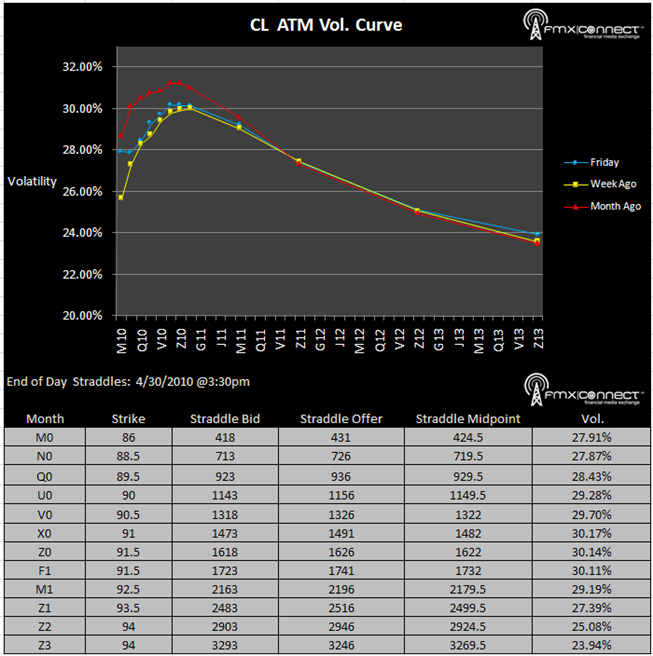

Volatility Term Structure

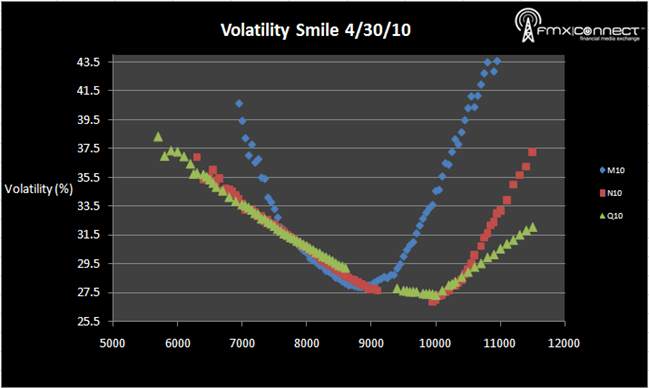

Volatility Smile

***From NYMEX Settlements

1. N10 7500 P.

2. U10 6000 P.

3. U10 1200 C.

Premium Subscribers (click here to register):

Volumes & Open Interest

End Of Day Straddles

Trade Blotter

Settlements