Natural Gas & Utility Generation

Natural gas prices plunged through last week’s support, touching off sell-stops as they fell. There was heavy fund selling, again, and there was decent selling by locals (floor traders on their own hooks) and by commission house longs liquidating on stop-loss orders. Producers appear to have been the best buying, with swap dealers also buying.

Traders seem to have incorporated Friday’s latest Baker-Hughes report, which showed another increase in the number of active rigs, to 905 rigs. Dow Jones noted yesterday that the rig count has increased by 19% over the last “few months.” The peak of 1,606, reached in September, 2008, is looking increasingly irrelevant, as each rig entering service today seems capable of extracting so much more natural gas from previously difficult-to-exploit shale formations.

One of the biggest natural gas stories in 2009 was the ability of rigs to bring out large supplies of hitherto ‘trapped’ gas from shale formations. The state of technology is such that these formations, once almost impossible to reach, have become the most easily – and most quickly – exploited sources of natural gas over the last year or so. The output-to-rig ratio has climbed dramatically, making the 1600 rigs in service 18 months ago an unneeded luxury in the current environment. The addition of eight or a dozen rigs now seems capable of tipping supplies to new heights. This has become a dominant factor in the market.

Courtesy Peter Beutel

Technical Recap

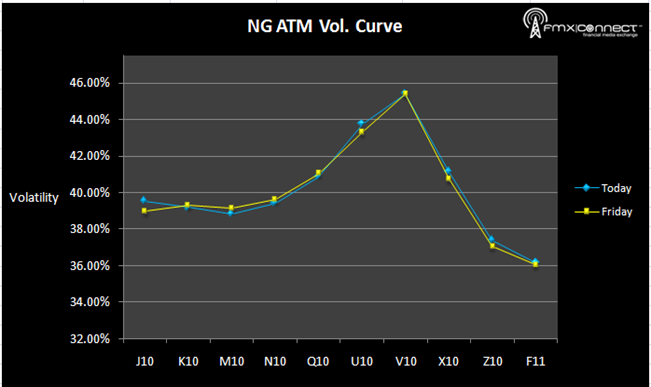

Volatility Term Structure

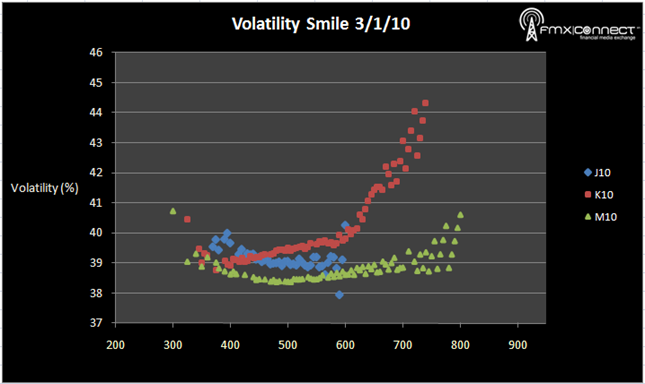

Volatility Smile

***From NYMEX Settlements

Significant Activity:

1. J10 4500 P

2. J10 5000 C

3. K10 4000 P

Premium Subscribers (click here to register):

Volumes & Open Interest

End Of Day Straddles

Trade Blotter

Settlements