Market Review for Monday

RUDE oil prices broke above last week’s important resistance level at $80.51, getting as high as $80.62, and it looked like the bulls had the momentum going their way. But, as happened all last week, prices could not sustain themselves above $80.00 and they sold off, ending the day in negative territory, below $79.00. Technically, yesterday was an extremely disappointing day for the longs.

Gasoline, now with April as the expiring contract, was over $2.20 yesterday in the early trading. According to Dow Jones, that looked extremely pricey to traders who had gone home on Friday with expiring gasoline trading beneath $2.08. Granted, this is now summer grade being traded. Nonetheless, it is still gasoline, and it takes time to internalize new numbers. The DJIA was up 78.53 points yesterday, which was supportive, but the dollar gained steadily through the session and it was just below &4.00 euro cents last night; major resistance is @ 74.15 euro cents.

Russian President Dmitry Medvedov, after speaking with French President Nicholas Sarkozy, has indicated an increasing willingness to vote in favor of fresh sanctions against Iran.

China, the nation with a thousand-year stare, countered this growing sense of impatience by repeating its mantra, “We believe there is still room for diplomatic efforts. We believe parties concerned should step up diplomatic efforts and push for progress in dialogue and negotiations to resolve the Iranian nuclear issue properly.”

Mr Medvedev met in Paris with Mr Sarkozy and said that Russia is ready … to consider introducing sanctions” if no diplomatic breakthrough is imminent. It’s not on today’s menu and maybe not on Iran’s menu at all.

The US dollar started off Monday morning under selling pressure, on continuing disappointment that prices had not broken the resistance at 74.15 euro cents (€0.7415) late last week. The dollar rallied into yesterday afternoon, and that helped take some of the starch out of oil prices.

Traders were also trying to integrate the latest figures on Opec production with the cartels’ scheduled meeting on March 17th. A Dow Jones survey showed Opec output up 110,000 bpd, to 26.895 million bpd, in February. Based on those numbers, Opec compliance with its own targeted cuts is down to 51%. It had been 82% compliance in March, a year ago. Traders see in these figures a de facto contentment or satisfaction with existing prices. As a result, it seems extremely unlikely that Opec ministers will propose or agree to any quota reductions when they gather in Vienna two weeks from tomorrow. Those who listen carefully to Saudi Arabian pronouncements believe that any Nymex price above $70 a barrel is acceptable to the kingdom.

It was warmer in the greater New York Metropolitan region yesterday than it has been in weeks or possibly months. That removed some urgency to buy.

Courtesy Peter Beutel

Technical Recap

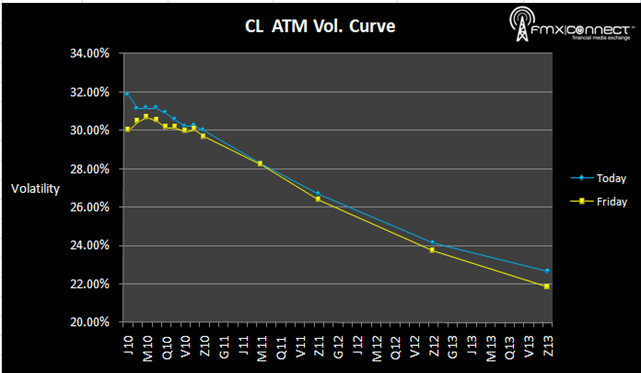

Volatility Term Structure

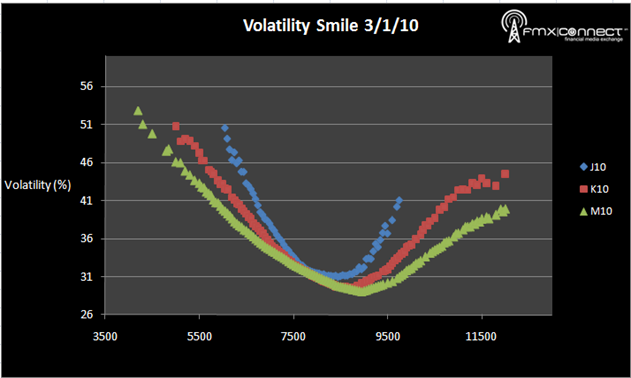

Volatility Smile

***From NYMEX Settlements

Significant Activity:

1. V10 1100 C

2. M10 6500 P

3. M10 1000 C

Premium Subscribers (click here to register):

Volumes & Open Interest

End Of Day Straddles

Trade Blotter

Settlements