Natural Gas & Utility Generation

Natural gas prices were lower again on Friday as traders responded to the latest Baker-Hughes report on drilling activity. The report showed an increase of just two rigs, but at 941 active rigs, the pressure has been building for a while. Even though gas prices have been in almost freefall, drilling activity continues to increase. It may be this factor that has been behind the heavy selling in this market by investment banks. They may have had solid advance knowledge that producers would continue to increase the number of active rigs in service. After all the technical damage done last week with the break below $4.00, and last week’s disappointing EIA report, and continuing forecasts for warmer weather, the rig count seems to have been the straw that broke the camel’s back. Prices dropped almost 11 cents per million bpd on Friday.

The latest CFTC Commitments of Traders Report shows a decline of almost 22 cents (for the ‘week’ from Tuesday to Tuesday March 16th to March 23rd) propelled by commission house and fund selling. Swap Dealers were liquidating existing longs and Producers were buying, which is what they have been doing over the last few weeks – despite a net short interest. The funds were not the biggest sellers over the period, breaking at least a three-week run. We had noted that three of the days in the period had crude prices moving in the opposite direction of gas prices, and we had wondered if we would see signs of spread unwinding in this report. We could not find exactly what we had expected, but we did notice that funds were liquidating long crude oil positions heavily, and that they stopped selling natural gas contracts as aggressively as they had over the previous three reports. They were still selling gas, and producers were still buying, and in the latest report commission houses were the biggest, gross, sellers. Swap dealers, which had been buying, seem to have thrown the towel in on this latest decline.

Courtesy Peter Beutel

Technical Recap

Volatility Term Structure

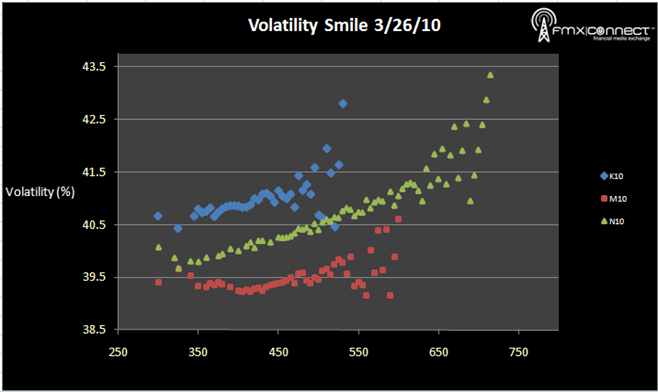

Volatility Smile

***From NYMEX Settlements

Significant Activity:

1. J10 4000 C

2. J10 4000 P

3. K10 3750 P

Premium Subscribers (click here to register):

Volumes & Open Interest

End Of Day Straddles

Trade Blotter

Settlements