Market Review for Friday

N trading Thursday night into Friday morning, oil prices posted decent gains, based on a resurgent euro (and corresponding weaker dollar). When the Nymex opened, the DJIA was up roughly 50 points, gold was higher, the euro was higher and oil opened and traded higher. The EU had removed a barrier (it had previously insisted on more than Greek bonds as collateral) on Thursday, then backed away from helping Greece, and then hammered out an IMF/EU solution Friday morning. That was the main factor behind the euro’s resurgence as we ended the week.

On Friday, the Commerce Department reported that 4th Quarter GDP had gown at a rate of 5.6%, revised down from an initially released rate of 5.9%. Expectations had been for a revision to 5.8%, so Friday’s revision was disappointing for the economic recovery. Also out Friday, the University of Michigan/Reuters figures on consumer confidence were better than expected, coming in at 73.6, rather than just the 73.0 which had been predicted. The ‘normal’ extraneous factors were bullish.

These factors helped equities in early trading, and higher equities and a higher euro helped push oil prices higher at first. But, the gains could not be held across the board. The euro kept its gains, but the DJIA came back towards unchanged while oil prices turned unexpectedly weaker, falling to unchanged and then plowing new negative territory to finish on the day’s lows.

This weakness was especially disappointing, given good consumer sentiment and the much stronger euro through the Nymex close. The final headlines said that oil prices had reacted poorly to the revision in GDP, although meshing the timelines precisely is a bit frustrating.

At the end of the previous week (on Thursday, March 18th), crude oil open interest had been up 129,459 contracts since the start of March. Heating oil open interest had been up 32,788 and gasoline had gained 61,168 contracts. A week later, on March 25th, crude open interest was up 12,756 contracts in March, heating oil had gained 25,751 and gasoline had the best net gains, still, at 62,421. Crude oil has seen a massive liquidation of long contracts held by funds, it appears. On Friday, the funds were not buying oil on a weak dollar.

Courtesy Peter Beutel

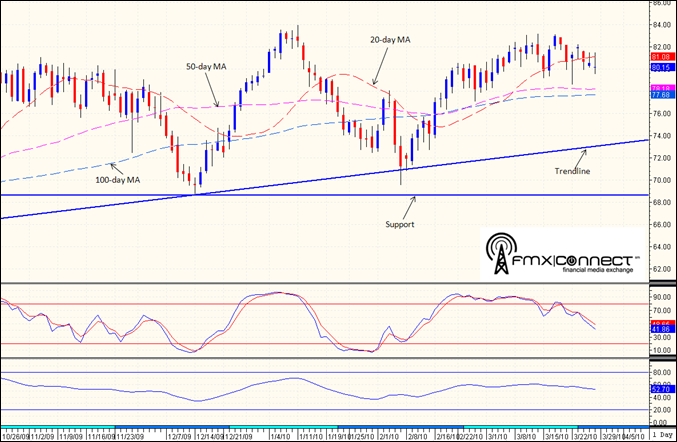

Technical Recap

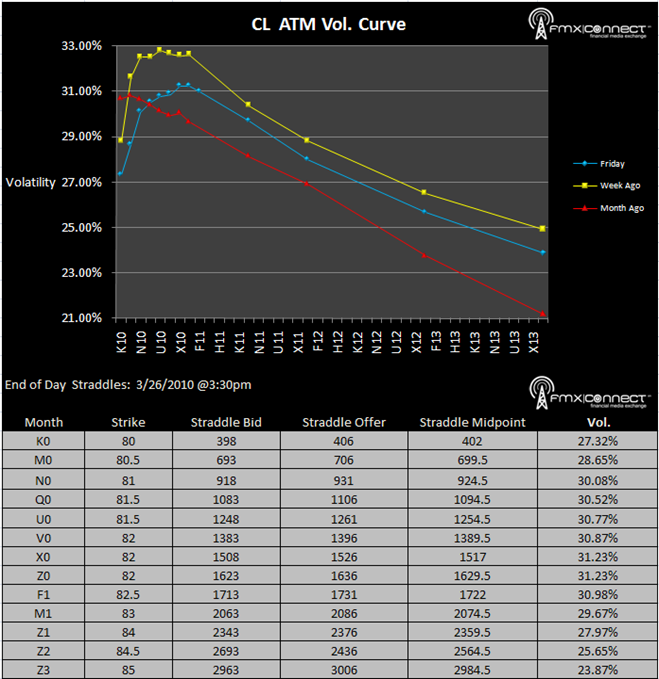

Volatility Term Structure

Volatility Smile

***From NYMEX Settlements

Significant Activity:

1. M11 7500 P

2. Z10 6000 P

3. K10 8500 C

Premium Subscribers (click here to register):

Volumes & Open Interest

End Of Day Straddles

Trade Blotter

Settlements