Natural Gas & Utility Generation

Natural gas prices advanced nearly 22 cents on Thursday, in their biggest advance since February 1st, 2010, two months ago. We have had sharp rallies that have gone nowhere before – witness the activity after February 1st. But, this rally came hot on the heel of trading funds shifting their positions. They had been heavily short and had pushed quotes lower for weeks or even months. In the theoretical week ended last Tuesday, they were getting long and covering shorts which, in this case, meant booking profits. Our first inclination would be to see it strictly as profit-taking going into the holidays, but the addition of fresh long positions suggests a change in bias – along with profit-taking.

This would represent a sea change in the outlook for prices. As we have noted, only the bearish factors have really received full coverage and play in this market over the last two months or so. All of the bullish factors have been ignored, cast aside or painted grimly as negative factors in disguise. There has been one overarching reason for this: Reporters are not going to discuss bullish possibilities while prices are declining. As a result, everything we have read on wire services and in market roundups has been bearish – because prices have fallen. If that were to change, the commentary will change along with it. Higher prices would force reporters to talk about the extraordinary reduction in the year-on-year surplus (and against the five-year average) that has taken place since October. And it would force a reevaluation of the prospects for natural gas demand in an economy that is recovering. Up until now, signs of economic recovery have had their potentially restorative effects restricted to every other commodity market except natural gas, which has never made any sense. If a recovery would be good for the goose (oil prices), why would it not also, perhaps even firstly and more dramatically, be good for the gander (natural gas). Clearly, obviously, logically, any recovery will be bullish for both oil and gas. Funds have obscured that skillfully.

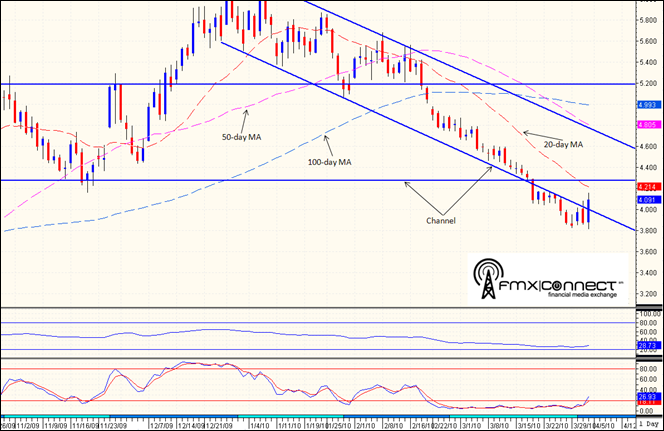

Courtesy Peter Beutel

Technical Recap

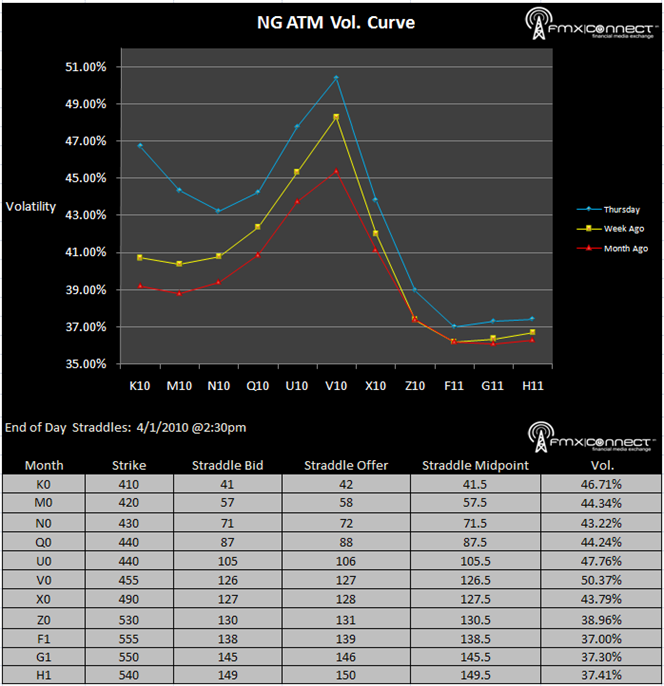

Volatility Term Structure

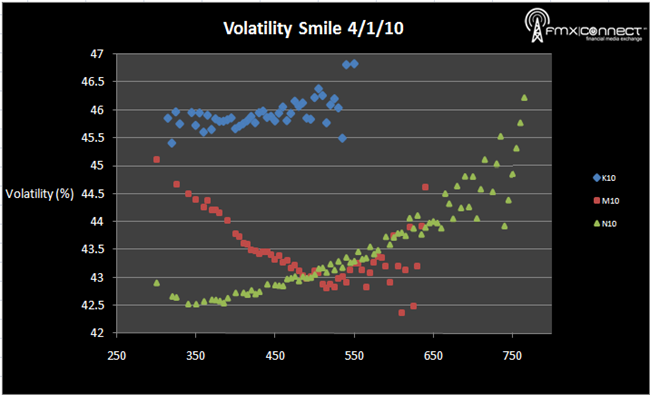

Volatility Smile

***From NYMEX Settlements

Significant Activity:

1. K10 5000 C

2. M10 5000 C

3. K10 4500 C

Premium Subscribers (click here to register):

Volumes & Open Interest

End Of Day Straddles

Trade Blotter

Settlements