Market Review for Thursday

HE oil complex continued moving higher on Thursday, even with a number of market participants already out for Passover and more getting ready to leave for the three-day Easter Weekend. Yesterday’s biggest and most bullish feature was the sudden decline in the dollar. That seems to have been the guiding light behind the higher prices.

On Thursday, the oil market was also able to take a cue from stronger equities, with the DJIA gaining more than 70 points on the day. European manufacturing strength seems to have been the best factor in this renewed sense of economic optimism. The UK had its strongest month in 15 years (in manufacturing) while Germany had its best month in 14 years, it was reported yesterday morning. These factors helped oil prices to rally. We noted earlier Thursday morning that China’s manufacturing sector expanded for a 13th consecutive month in March, with the Purchasing Managers’ Index (in China) up to 55.1 in March, up from 52.0 in February. At the same time, factory orders placed at US factories in February increased for the 10th time in the last 11 months, Bloomberg reported. Inventories and backlogs climbed by their greatest amount in a year, both signs that US manufacturing will be a source of strength in the months ahead. Orders increased by 0.6% in February, following a revised but sizzling gain of 2.5% in January.

Those figures provided solid justification for the rise in prices seen Thursday, but they were hardly on a par with the loss of a major refinery, an attack on an oil facility or a sudden revision higher in driving demand. Any of those might have made us feel right at home reading about higher prices on April Fools’ Day. Instead, we had to be content with momentum higher, the seasonal tendency for higher prices, and better manufacturing activity, accompanied by a lower dollar and a stronger DJIA. Twenty-four years ago Thursday, crude oil prices were running dramatically higher on the day, after having touched a multi-generational low of $9.75 a barrel earlier in the morning. President Reagan had sent Vice President George HW Bush to talk the Saudis into cajoling prices higher. It worked.

Courtesy Peter Beutel

Technical Recap

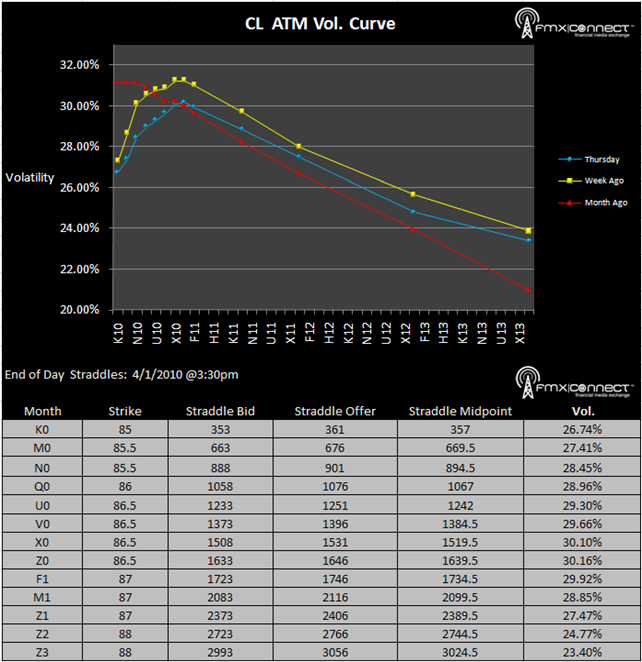

Volatility Term Structure

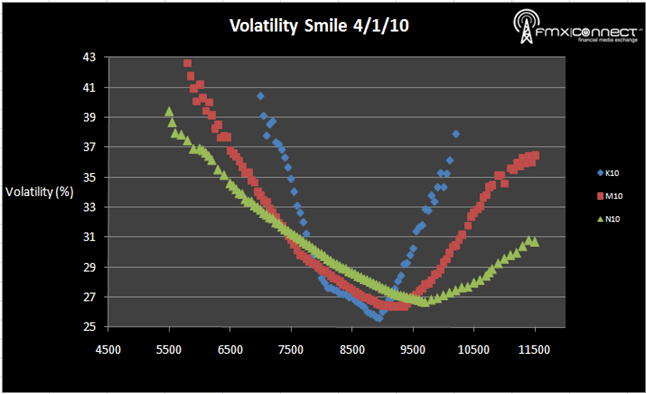

Volatility Smile

***From NYMEX Settlements

Significant Activity:

1. K10 5000 C

2. M10 5000 C

3. K10 4500 C

Premium Subscribers (click here to register):

Volumes & Open Interest

End Of Day Straddles

Trade Blotter

Settlements