Natural Gas & Utility Generation

Natural gas prices rallied a little more than a nickel on Friday, and the immediate supposition was that it was related to the “bombshell.” The assumption is that Goldman and other investment banks were short natural gas futures and either they were covering shorts or other traders were buying or covering shorts on the assumption that Goldman and other investment banks would start covering their shorts. Funds have been selling in recent weeks.

There were stories out Friday that suggested that the investment bank in question had started liquidating longs in oil futures (and covering shorts in gas) just before Easter. We noted at the time that we were seeing signs that Managed Money accounts were getting out of existing positions. It looked like they were taking a breather ahead of the holidays coming up. The story out Friday suggested that Goldman may have been getting out before Easter because it knew the lawsuit was coming. Managed Monet accounts were selling in the most recent CFTC report.

The official story from most wire services was that there was good “bargain-hunting” on Friday, after Thursday’s steep decline in prices. From our perspective, we would prefer to see it as “technical buying” above the major low at $3.81. Of course, prices were not exactly moving in on that level; they were a good 15 cents above the low. Nonetheless, as long as prices do remain above 3.81, we will tend to see buying in natural gas as technical buying above the lows. Until and unless we break and settle beneath that price, we would assume that the sideways configuration has not been negated. It is difficult to be bullish in this market, but we do see support holding.

Courtesy Peter Beutel

Technical Recap

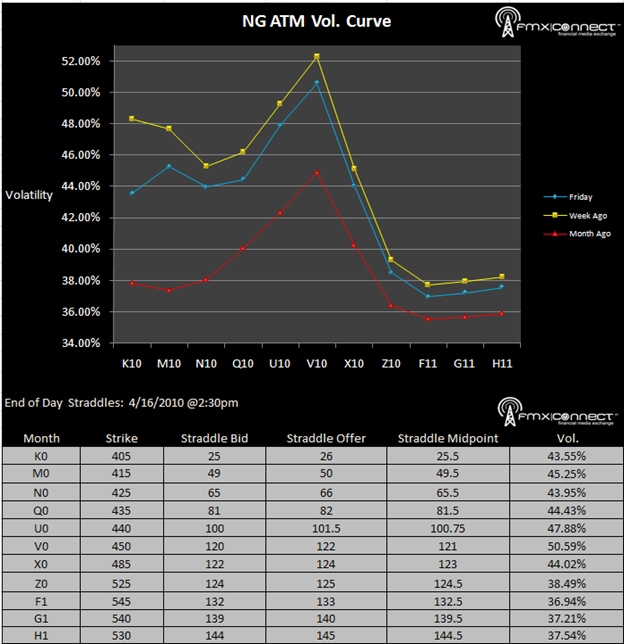

Volatility Term Structure

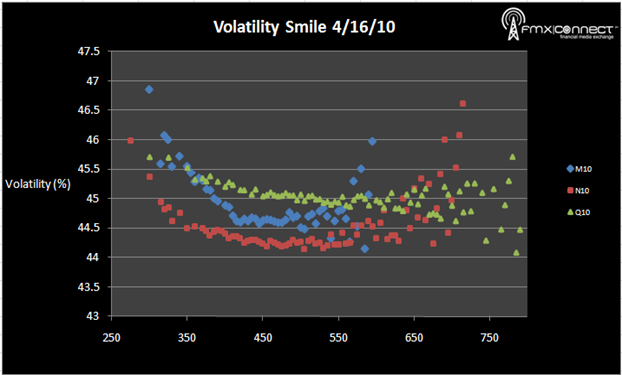

Volatility Smile

***From NYMEX Settlements

Significant Activity:

1. K10 4500 C

2. K10 3750 P

3. V10 3000 P

Premium Subscribers (click here to register):

Volumes & Open Interest

End Of Day Straddles

Trade Blotter

Settlements