Market Review for Friday

Oil prices were under selling pressure from the opening bell on Friday, having sold off in trading overnight. In the trading overnight in Asia and in Europe, oil prices were being sold in reaction to a lower equities and a stronger US dollar. This was in sharp contrast to the previous six out of seven days, or the period ended on Wednesday, during which fundamentals had played a leading role. For the first five days of that period, ending on Tuesday, oil prices had declined based on heavy inventory levels. On Wednesday, they rallied after this week’s DOE report showed a drawdown in crude oil stocks and a slightly larger-than-expected draw in gasoline inventories. Demand had also shown some improvements and that helped prices rally on Wednesday.

Around 10:42 AM EST, on Friday, prices started falling as the stock market started dropping, based on weakness in Goldman Sachs. Goldman has been accused of malfeasance, of putting together a portfolio that had been designed by one of its customers as being ideal for selling short. The question is whether Goldman had been forthcoming with that information as it sold the portfolio of CDO’s to other buyers.

As one of associates at FMXConnect put it, “Lawsuits mean uncertainty, and that is not good for any holdings.” The more we thought about it, watching prices for everything, from the euro to gold to equities and back to oil, falling, we realized that this quote had succinctly summed up the problem for the whole day. Goldman losses doubled by noon, going from down $12 (around 10:30 AM) to off $24, and the DJIA was down $130 at that time, as investors took profits in a number of financial stocks.

Sean Cota, of Cota & Cota Oil, NEFI and PMAA, sent us a note on Friday, pointing out that banks now account for 65% of US GDP, up from 17% in 1995. There was a time when an assault on Goldman Sachs could have been ignored by the equities markets, as a whole. But, that is not the case in 2010. CNBC was calling it: “the Goldman Bombshell” by noon, with its anchors wondering if this could spell an end to the bull market in equities. There was a sudden disillusion with the so-called “carry” trade, or the gluttony for risk that is so frequently described simply as an “appetite.”

Friday’s decline in oil prices was significant. Seven of the last eight days have now been lower, and Friday’s activity finally did hurt the market technically. What is most interesting is that the biggest loss of the entire period came from Friday’s disillusion with Wall Street and risk rather than from the five or six days during which traders were looking at oil market fundamentals. Technically, we do now have the market in position to decline. If the interest in fundamentals continues and risk appetite goes away as a major factor, this could be the start of a major decline in oil prices. And with so many record days in volume recently, one has to wonder how all these factors come together. That may be the bigger story that emerges this week and beyond.

Courtesy Peter Beutel

Technical Recap

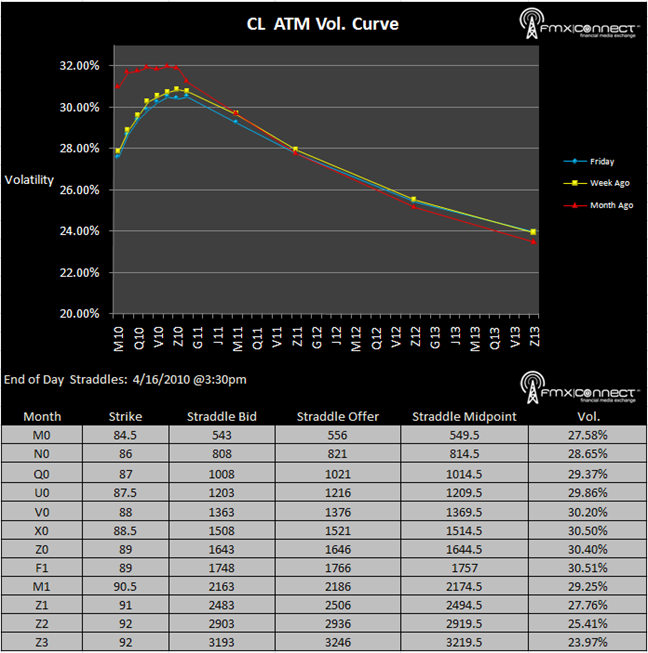

Volatility Term Structure

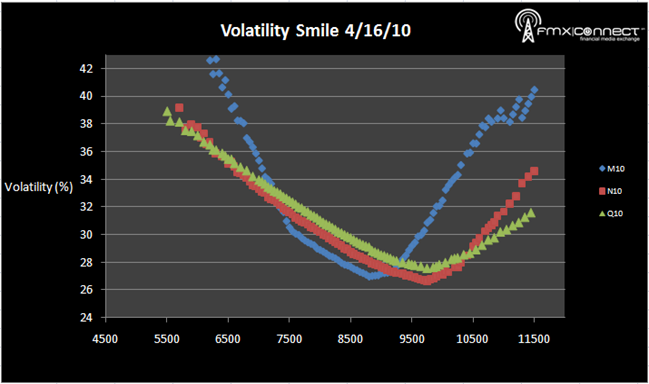

Volatility Smile

***From NYMEX Settlements

Significant Activity:

1. N10 1100 C

2. N10 8000 P

3. N10 9000 C

Premium Subscribers (click here to register):

Volumes & Open Interest

End Of Day Straddles

Trade Blotter

Settlements