Natural Gas & Utility Generation

Natural gas prices dropped 7.1 cents per million Btu on Friday as traders reacted to the latest Baker-Hughes report that showed a jump in the rig count of 18. That places the total at 969. More importantly, it suggested to traders that the lower prices seen in recent months are not low enough to give us a pullback in drilling. In fact, the new economics of shale-gas may mean that it can be profitable to drill new wells at levels that would not have been profitable just two or three years ago. In any event, even if it later turns out that $4.00 gas is indeed too low to foster new drilling, this latest report suggests differently. Part of it comes from the fact that a number of shale-gas leases require drilling to start by a specified date.

This comes just as questions about the economic recovery are coming into focus. While economic signals have been mixed for months, alternating data of hope with ones of caution or even worry, the tie-breaker for more than a year has been the stock market, the most iconic forecaster of future economic activity to millions of ordinary Americans. And, up until its steep decline in early May, it had been trending higher, seemingly telling us that the more positive data were the ones that would prevail. Even unemployment, which has been the mostly stubbornly difficult signal to turn around, had seemed to be on its way to better levels. But the fallout of the recent decline in equities and commodities has not yet been fully integrated into the picture, and the most recent unemployment figures have taken a turn for the worse.

Last week’s EIA underground storage report showed less of a build than had been expected and less of a build than had been seen a year ago or over the course of the preceding five years. As a result, it was a bullish report. It just was not bullish enough to push gas prices higher. Last week’s EIA report showed a build of 76 bcf, which was more bullish than the expectation for a build of 78 bcf. It was also better than last year’s build of 100-103 bcf and it was better than the five-year average build of 93 bcf. But, it still leaves storage levels 73 bcf and 3.49% higher than a year ago and 308 bcf and 16.58% above the five-year average for this time of year.

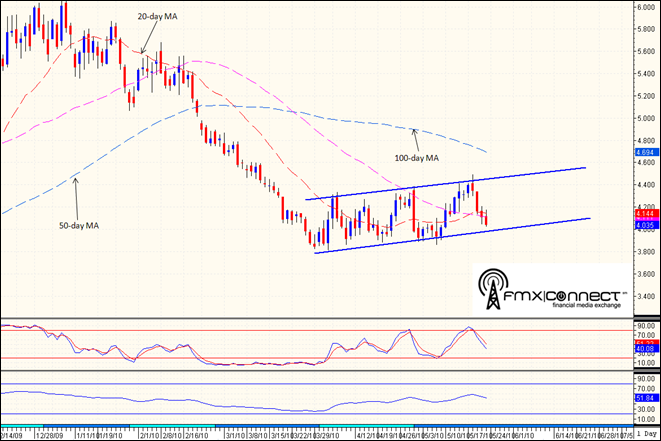

Courtesy Cameron Hanover

Technical Recap

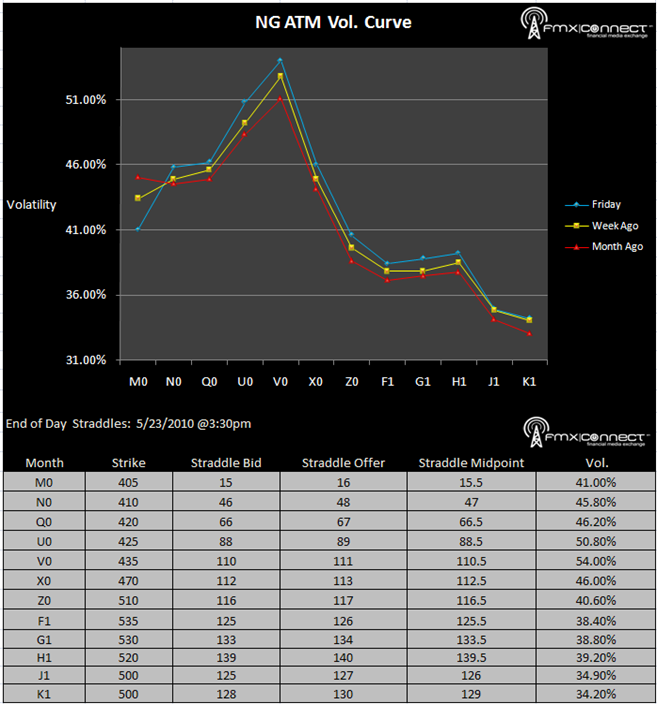

Volatility Term Structure

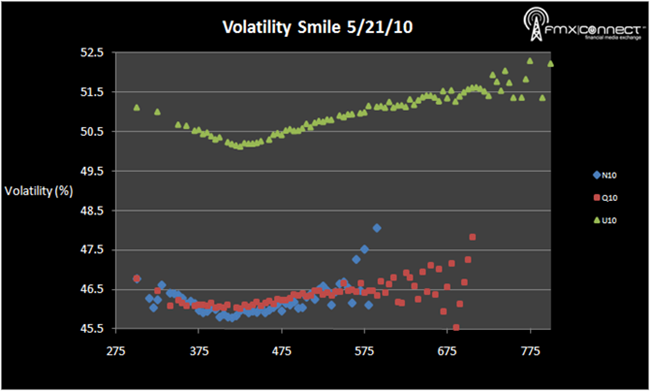

Volatility Smile

***From NYMEX Settlements

Significant Activity:

1. M10 4100 P

2. M10 4250 C

3. X10 4250 P

Premium Subscribers (click here to register):

Volumes & Open Interest

End Of Day Straddles

Trade Blotter

Settlements