Market Review for Friday

il prices were lower again on Friday, despite an unchanged euro market and a decent rally in equities. Although a substantial part of the rally came later in the day in equities, the DJIA still ended up 125.38 points, at 10,193.39. There was support just above the 10,000 level. Oil prices were lower less on equities on Friday than on fears of a weakening economy and on heavy supplies available in oil markets right now. Distillate stocks dropped in the latest report, but they had been near their highest levels since 1989, coming into the week. Gasoline inventories are still near their highest levels in more than two decades, and crude oil stocks are abundant, with record levels at Cushing, Oklahoma, the Nymex hub.

Even if investors saw a reason to be buying equities late yesterday afternoon, they did not and probably would not be inspired by the same reasons to buy oil futures. The latest commitments of traders reports (from the CFTC) showed fund, or managed money, liquidation and short-selling as major factors behind lower prices in all three oil markets through Tuesday afternoon. We believe that they have essentially rethought their entire exposure to risk over the last three weeks.

A major part of their thinking has centered on a growing fear that the economy has reached a mid-term high point and seems to be working back down towards a “W” bottom that could take us back through everything we have just been through. Economic indicators are still mixed on that point, but the DJIA is sending a clear signal in its correction that further recovery may be further away than hoped. We had yet to see any genuine growth in employment to begin with, and that made observers leery when they saw Thursday’s weekly figures show a pullback in employment, with unexpectedly higher first-time claims being submitted. The fear is that those numbers could be a beginning rather than an aberration or end.

The bottom line in the oil markets is two-fold. Without economic recovery and growth, one full group of potential buyers – investors – has no interest in buying oil. And without that recovery as a backdrop, recent gains in consumption are likely to be short-lived. That leaves us with supplies, which are, as we noted, at or near historical highs. Without stronger economic growth, it will be very hard to build a bullish picture for the oil markets – either as an investment, or as a commodity with a positive supply-demand balance.

And, as we look at the bigger picture, we now believe that the entire move from $32.70 to $87.15 was a correction in a bigger bear market. We do not believe that we have a leg of equal length lower because it would not be possible, but one fact that was bothering us a lot about the economic recovery as we saw it unfolding through April was that we have never had a long, sustained economic recovery in the US without there being low, real oil prices to generate strong consumer spending and business growth.

There was nothing in Friday’s activity that suggests the declines in equities or in oil have ended. There has been a large amount of long liquidation in the oil markets over the last week, and that is theoretically supportive, but we need to see it end before prices can build a base or turn back up. The same is certainly true in equities. The decline in stock markets (equities) also removes one of the pillars that had been built beneath assumptions of an economic recovery. And we will need that to eat into oil inventories or to attract investors back into any asset classes.

Courtesy Cameron Hanover

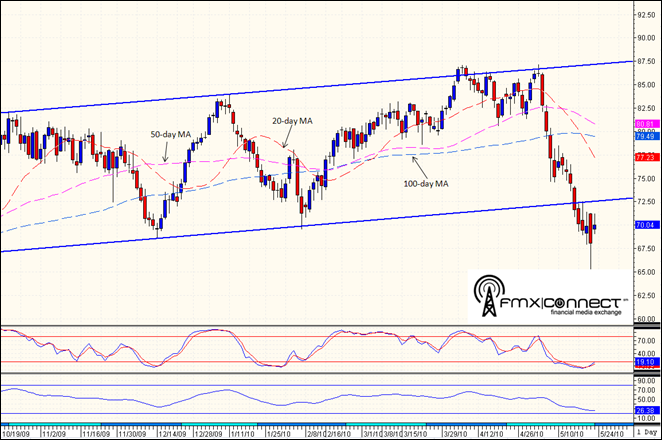

Technical Recap

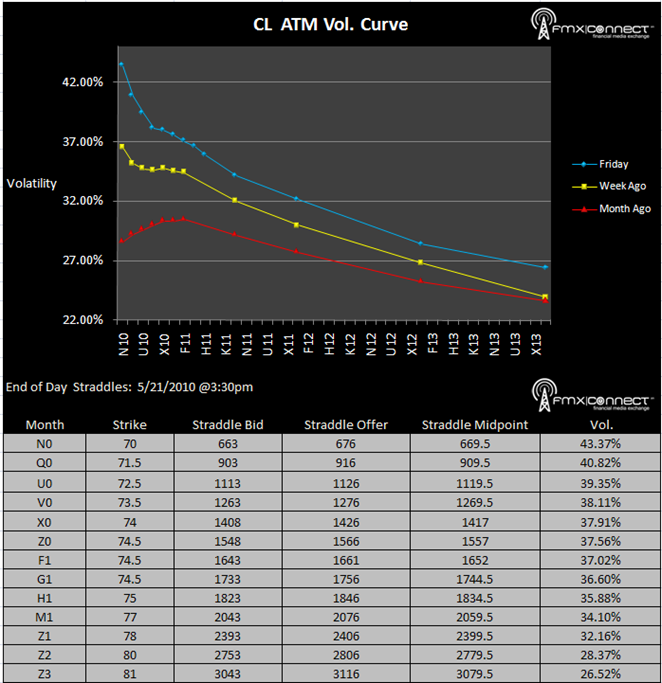

Volatility Term Structure

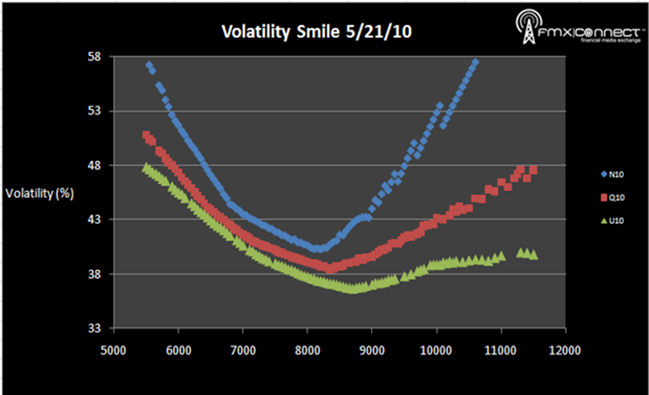

Volatility Smile

***From NYMEX Settlements

1. N10 6500 P.

2. N10 6000 P.

3. Z10 8000 C.

Premium Subscribers (click here to register):

Volumes & Open Interest

End Of Day Straddles

Trade Blotter

Settlements