Natural Gas & Utility Generation

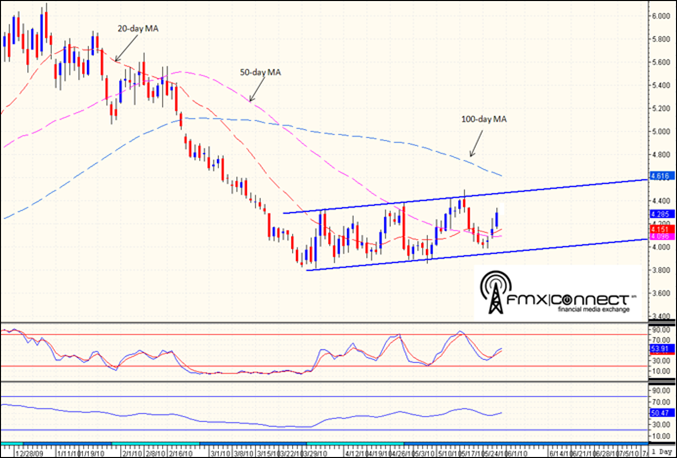

Natural gas prices rallied 4.7 cents on Friday to cap off a four-day 30-cent per million Btu rally over the last four days of trading last week. On Monday and Tuesday, natural gas prices touched a low of $3.986, which is hardly a technician’s idea of a perfect test of support at $3.81, but one that is near enough for more fundamentally-oriented traders to state with confidence that we saw a test of the major lows last week. And, from the perspectives of a number of more technically-inspired traders, what one should take away from last week was that prices broke $4.00 per million Btu without needing to drop any further. In that respect, the twin lows at $3.986 acted very much like important tests of $3.81 and may have accomplished everything that any full-fledged actual test of that figure could have achieved. The sideways to higher trend remains intact along with the critical support, at least for now.

The trigger for the buying came from the National Oceanic & Atmospheric Administration (NOAA), which said on Thursday that it is predicting an “active to extremely active” Atlantic hurricane season, with a 70% probability of there being 14-23 named storms, with eight to 14 hurricanes, three to seven of which could become” major” Category Three storms or worse. The NOAA believes that this storm season could fit into the cycle that began in 1995, when there were 19 named storms. The cycle includes the record-breaking 2005 season, as well as the very active 2008 and 1995 seasons. 2005 had 28 named storms, 15 hurricanes and seven major hurricanes, including hurricanes Katrina and Wilma. The 2008 season had 16 named storms, eight hurricanes and five major hurricanes, including Hurricanes Gustav and Ike. NOAA says there is an 85% chance of a more active storm season this summer.

Last Thursday’s EIA report showed a build of 104 bcf on estimates calling for an increase of 100 bcf. That was seen as being slightly bearish, but traders were looking at the NOAA storm projections, and they won out in the final analysis. And, at the heart of the rallies on Wednesday and Thursday, there was a clear message that it will take more than ordinary selling, based on poor industrial demand and abundant amounts in storage, to push prices below the critical support at $3.81.

Courtesy Cameron Hanover

Technical Recap

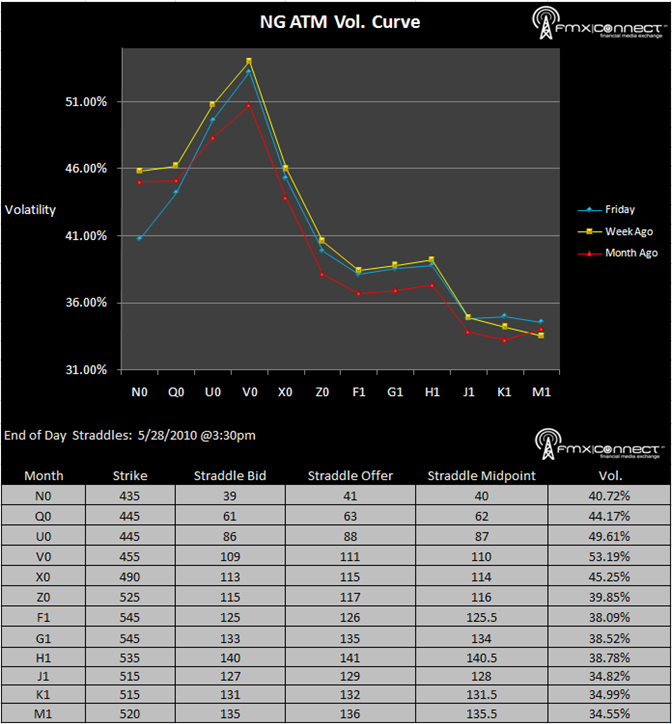

Volatility Term Structure

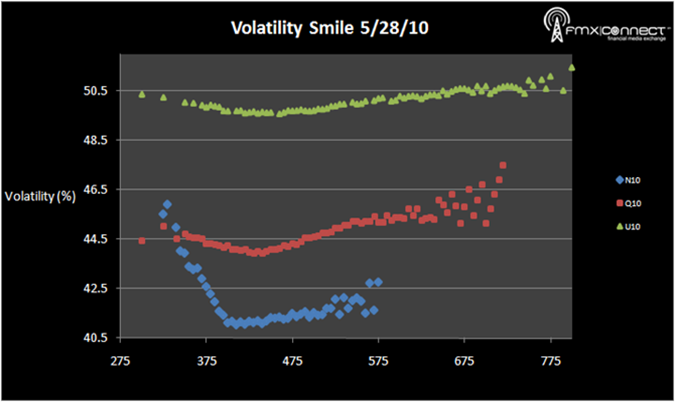

Volatility Smile

***From NYMEX Settlements

Significant Activity:

1. N10 4500 C

2. N10 5200 C

3. N10 3750 P

Premium Subscribers (click here to register):

Volumes & Open Interest

End Of Day Straddles

Trade Blotter

Settlements