Market Review for Friday & the Weekend

ur last report was out last Tuesday, and we hope our readers noticed our note on Monday and Tuesday explaining that we had to take time off the move offices. We are at our new address, now, and are eager to get back into the swing of the market.

On Wednesday, oil prices advanced briskly, despite a close in the DJIA below 10,000 – its first in almost four months. It was down roughly 69 points on the day, after having been up 135 points in early trading that day. The reason for the selloff – and this could seemingly be written about almost any day in May – was continuing nervousness about Europe, specifically about euro-zone debt. The new ‘straight-line contention’ is that a need for fiscal austerity in economies, starting with Greece, will preclude any kind of stimulus and will, in fact, lead to dramatic cuts in public-sector spending. This would be bad news for the nascent recovery. And, the worst part right now is that we are not sure how many economies have been infected by the virus for which the only cure would seem to be fiscal austerity.

Prices continued higher on Thursday, with crude oil posting gains of more than $3.00 a barrel. Equities were a large, positive influence in Thursday's trading, with the DJIA gaining 284.54 to finish at 10,258.99. Strong demand figures from last week’s DOE report remained an important part of the bullish picture, but heavy inventories continue to hang over the oil complex. Heating oil led products higher, with both heating oil and gasoline prices registering gains of more than seven cents a gallon, on top of Wednesday’s gains of nearly five cents in heating oil and almost four cents in gasoline.

Also on Thursday, West Coast gasoline prices widened their differentials against the Nymex, as regional traders tried to price product in the face of continuing problems at BP’s Carson, California refinery (265,000 bpd). West Coast inventories dropped last week, partially on lower imports and production.

On Friday, prices sold off, as the June refined products contracts expired, and with traders taking profits on long positioned before the weekend. The specific fear was that traders would return from the long weekend to find some new euro-zone crisis or problem pressing either the euro or the stock market lower. As it was, yesterday, on Monday, crude futures made timid gains, with both the US and UK observing holidays. The dollar was slightly lower, and was seen as a source of support for prices. Still, volume was light yesterday.

As we start this new week, traders will be looking at the euro-zone for signs that the sovereign debt crisis might have ended, or that Europe, as a whole, has found a way to salve what has been an open, running wound. The US stock market will also provide traders with much needed cues on the state of both the investor and the economy.

For us, last week’s most significant development came from demand. Four-week distillate demand, after being essentially unchanged five weeks ago, is now 15.76% higher than a year ago. Total refinery output, is now 1.266 million bpd and 6.93% higher than a year ago. These are some definitely positive changes. We feel that some of the gains we saw last week were the result of this stronger demand.

Courtesy Cameron Hanover

Technical Recap

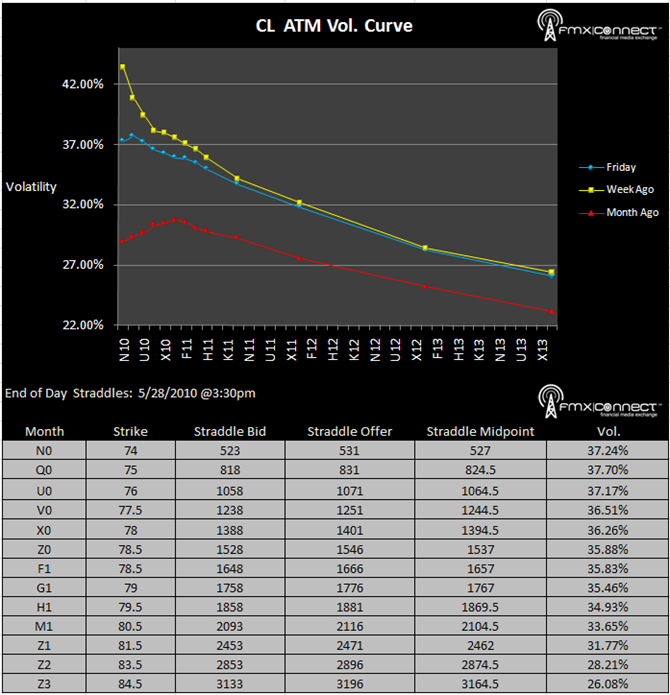

Volatility Term Structure

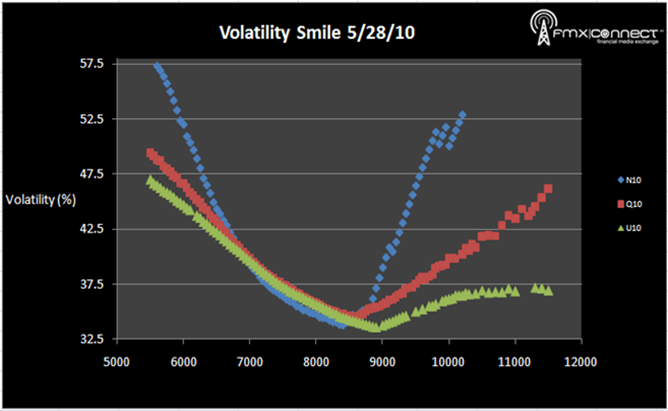

Volatility Smile

***From NYMEX Settlements

1. N10 7000 P.

2. N10 8000 C.

3. Z10 1250 C.

Premium Subscribers (click here to register):

Volumes & Open Interest

End Of Day Straddles

Trade Blotter

Settlements